Why We Give

VWU Professor Invests in Students’ Futures With Special Gift

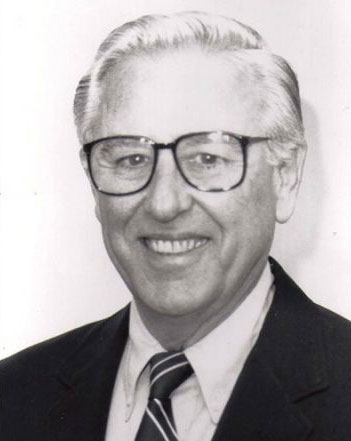

Dr. Charles Kessler, ordained minister and beloved professor of Religious Studies, cared as much for his students’ lives as for their learning. See how he and his wife, Viola, used their estate plan to extend his impact at Virginia Wesleyan University.

Dr. Charles Kessler, ordained minister and beloved professor of Religious Studies, cared as much for his students’ lives as for their learning. See how he and his wife, Viola, used their estate plan to extend his impact at Virginia Wesleyan University.

Read More

New Campus Entranceway Named for Sue Benton Birdsong

The strength of Virginia Wesleyan today can be traced in significant ways to the generosity and forethought of our dedicated supporters, like Sue and George Birdsong.

The strength of Virginia Wesleyan today can be traced in significant ways to the generosity and forethought of our dedicated supporters, like Sue and George Birdsong.

Read More

Trustee Emeritus S. Frank Blocker, Jr., Remembered as a Businessman and Generous Benefactor

The impact of S. Frank Blocker, Jr.’s generosity will be felt far and wide on Virginia Wesleyan University’s campus for generations to come.

The impact of S. Frank Blocker, Jr.’s generosity will be felt far and wide on Virginia Wesleyan University’s campus for generations to come.

Read More

Fond Memories Inspire an Estate Gift

There was no single event that encouraged Dan Mason '88 to leave a legacy here at Virginia Wesleyan College. Rather, a series of life-shaping experiences led him down the path to the creation of his estate gift.

There was no single event that encouraged Dan Mason '88 to leave a legacy here at Virginia Wesleyan College. Rather, a series of life-shaping experiences led him down the path to the creation of his estate gift.

Read More

Making A Difference in the Life of a Student

While Robin came to Virginia Wesleyan College in 1970 to gain an education, he left with the ability to educate thousands.

While Robin came to Virginia Wesleyan College in 1970 to gain an education, he left with the ability to educate thousands.

Read More

Leaving a Legacy While Helping Others

To The Honorable Deborah Paxson '75, the opportunity to leave a legacy at Virginia Wesleyan College is just as important as helping others graduate from her alma mater. Deborah graduated from VWC in 1975 and was very pleased with the liberal arts education she received.

To The Honorable Deborah Paxson '75, the opportunity to leave a legacy at Virginia Wesleyan College is just as important as helping others graduate from her alma mater. Deborah graduated from VWC in 1975 and was very pleased with the liberal arts education she received.

Read More

Close-Knit Community, Family Experience Prompts Gift

Robert and Mercedes McNutt were first introduced to Virginia Wesleyan in 2006 when their oldest son, Josh, earned a scholarship to attend the College. Not long after, their younger son, Matt, chose to attend VWC as well.

Robert and Mercedes McNutt were first introduced to Virginia Wesleyan in 2006 when their oldest son, Josh, earned a scholarship to attend the College. Not long after, their younger son, Matt, chose to attend VWC as well.

Read More

Information contained herein was accurate at the time of posting. The information on this website is not intended as legal or tax advice. For such advice, please consult an attorney or tax advisor. Figures cited in any examples are for illustrative purposes only. References to tax rates include federal taxes only and are subject to change. State law may further impact your individual results. California residents: Annuities are subject to regulation by the State of California. Payments under such agreements, however, are not protected or otherwise guaranteed by any government agency or the California Life and Health Insurance Guarantee Association. Oklahoma residents: A charitable gift annuity is not regulated by the Oklahoma Insurance Department and is not protected by a guaranty association affiliated with the Oklahoma Insurance Department. South Dakota residents: Charitable gift annuities are not regulated by and are not under the jurisdiction of the South Dakota Division of Insurance.